The tool evaluates the best reinsurance program for selected risks considering

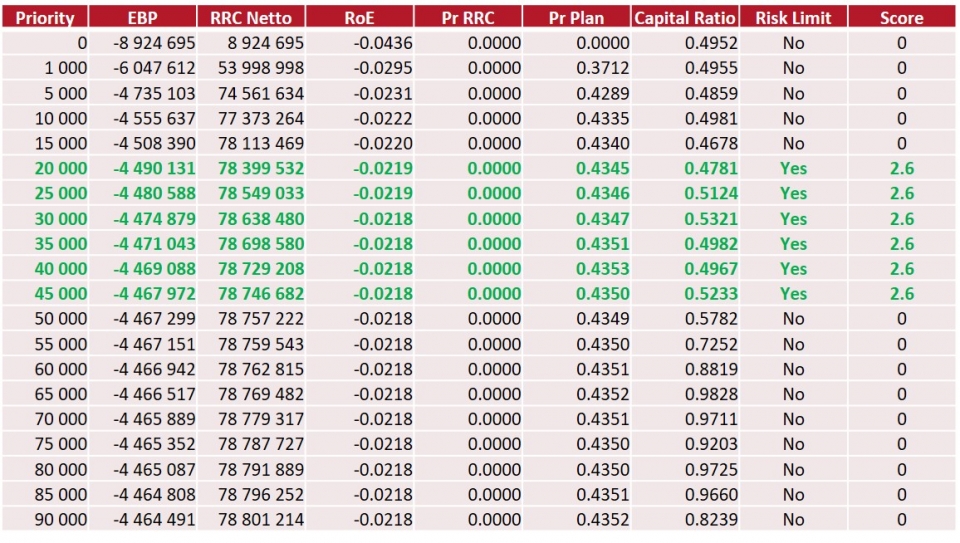

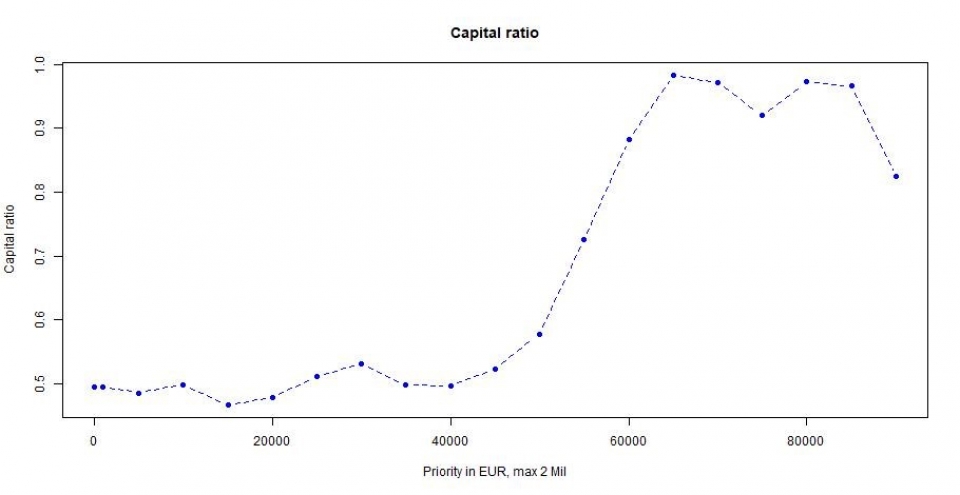

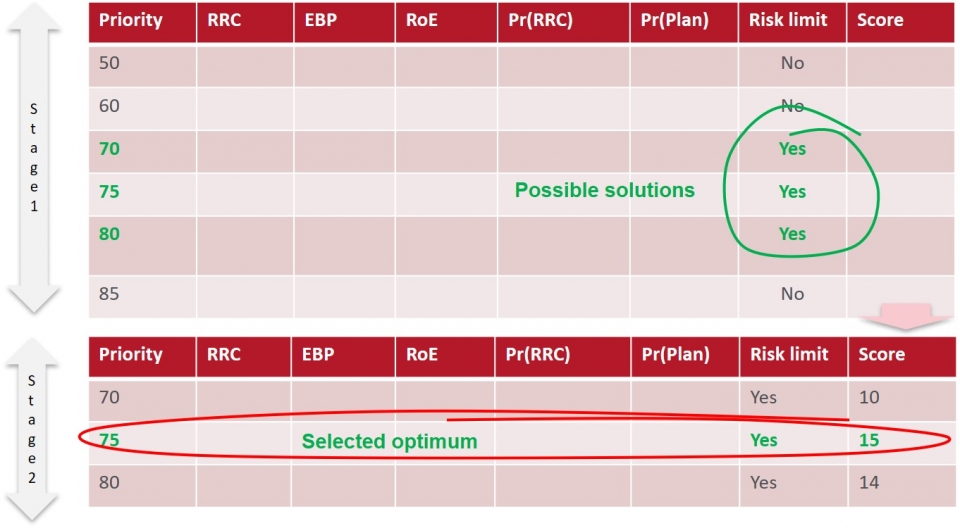

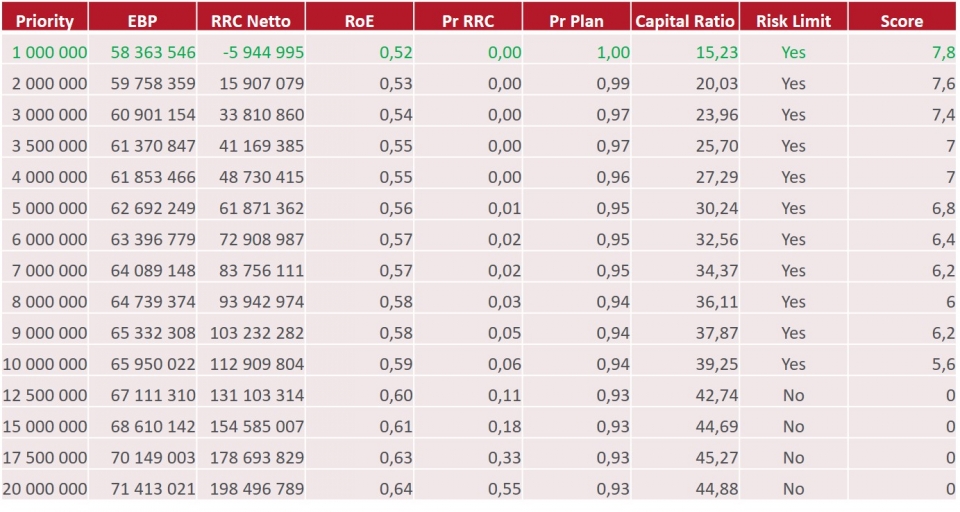

- risk optimum - many different rsk metrics such as regulatory capital, expected book profit, return on equity, economic value added etc.

- commercial optimum - evaluation considers predefined risk limits and further risk scoring.

Easy to compare different programs considering various measures providing acceptable options and theoretically the optimal program.

It helps you with a definition of the optimum reinsurance strategy, which will reflect the given risk appetite and will be implemented via definition of appropriate risk metrics.

If relevant, this analysis also includes the definition of the optimum settlement strategy of annuity claims. This solution is based on simulation of the technical results and the related reduction in cost of capital under various reinsurance scenarios.

We may provide a visualization of alternatives and what if analysis (impact on expected profits, capital, etc.) for different reinsurance programs.

Key benefits of the tool:

- Clear articulation of the risk appetite via intuitive risk adjusted performance measures

- A sound basis for a more detailed assessment of the benefits of entering into reinsurance treaties

- Input to capital allocation procedures across the entities within the Group and to optimization of a Group-wide reinsurance program

- Monitoring and reporting of actual risk exposures and related KPIs

Please contact us for further information.

If you have any questions please use the contact form below.